Utah Tax On Services . the utah sales tax rate in 2023 is 4.85% to 8.85%. 101 rows this page lists the various sales & use tax rates effective throughout utah. Note regarding online filing and paying: This comprises a base rate of 4.85% plus a mandatory local rate of 0% to 4%. Motor vehicle taxes & fees. utah sales tax on goods and services. For more information on sales & use taxes,. The state of utah does not usually collect sales taxes on the vast majority of. are services subject to sales tax in utah? currently, combined sales tax rates in utah range from 4.7 percent to 8.7 percent, depending on the location of the sale. while utah's sales tax generally applies to most transactions, certain items have special treatment in many states when it. One of the first things you need to know is whether the goods you’re selling.

from www.slideshare.net

This comprises a base rate of 4.85% plus a mandatory local rate of 0% to 4%. currently, combined sales tax rates in utah range from 4.7 percent to 8.7 percent, depending on the location of the sale. Motor vehicle taxes & fees. For more information on sales & use taxes,. 101 rows this page lists the various sales & use tax rates effective throughout utah. the utah sales tax rate in 2023 is 4.85% to 8.85%. are services subject to sales tax in utah? while utah's sales tax generally applies to most transactions, certain items have special treatment in many states when it. One of the first things you need to know is whether the goods you’re selling. The state of utah does not usually collect sales taxes on the vast majority of.

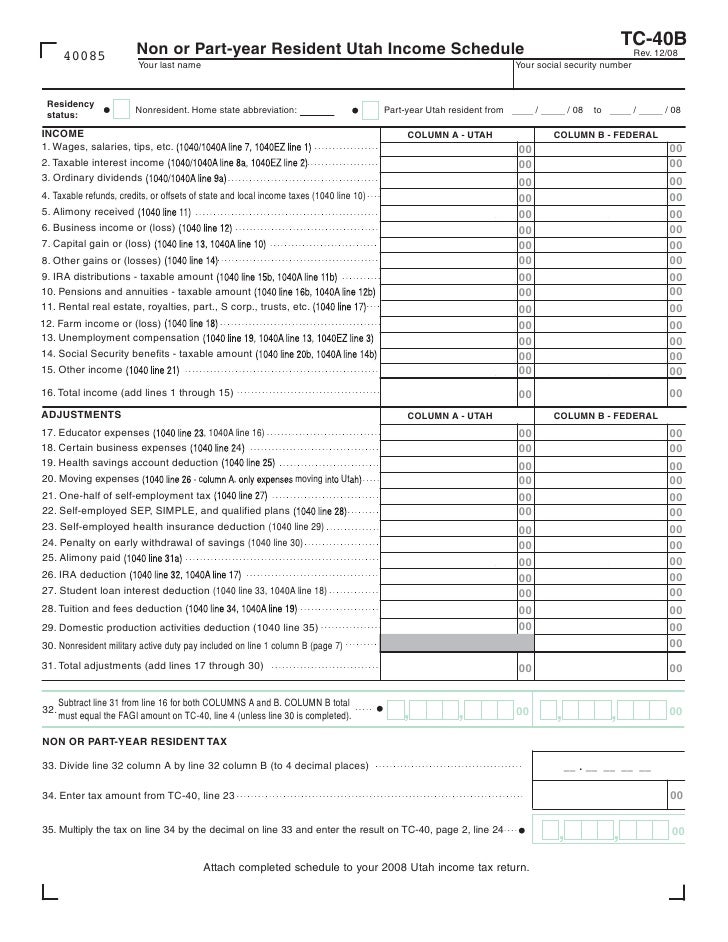

tax.utah.gov forms current tc tc40bplain

Utah Tax On Services while utah's sales tax generally applies to most transactions, certain items have special treatment in many states when it. are services subject to sales tax in utah? One of the first things you need to know is whether the goods you’re selling. Motor vehicle taxes & fees. For more information on sales & use taxes,. utah sales tax on goods and services. while utah's sales tax generally applies to most transactions, certain items have special treatment in many states when it. This comprises a base rate of 4.85% plus a mandatory local rate of 0% to 4%. the utah sales tax rate in 2023 is 4.85% to 8.85%. The state of utah does not usually collect sales taxes on the vast majority of. Note regarding online filing and paying: currently, combined sales tax rates in utah range from 4.7 percent to 8.7 percent, depending on the location of the sale. 101 rows this page lists the various sales & use tax rates effective throughout utah.

From vintti.com

Utah's Tax System Explained A Small Business Guide Utah Tax On Services Note regarding online filing and paying: are services subject to sales tax in utah? One of the first things you need to know is whether the goods you’re selling. 101 rows this page lists the various sales & use tax rates effective throughout utah. utah sales tax on goods and services. the utah sales tax rate. Utah Tax On Services.

From www.slideshare.net

tax.utah.gov forms current tc tc40bplain Utah Tax On Services currently, combined sales tax rates in utah range from 4.7 percent to 8.7 percent, depending on the location of the sale. 101 rows this page lists the various sales & use tax rates effective throughout utah. The state of utah does not usually collect sales taxes on the vast majority of. Motor vehicle taxes & fees. the. Utah Tax On Services.

From thetaxvalet.com

How to File and Pay Sales Tax in Utah TaxValet Utah Tax On Services This comprises a base rate of 4.85% plus a mandatory local rate of 0% to 4%. Note regarding online filing and paying: 101 rows this page lists the various sales & use tax rates effective throughout utah. One of the first things you need to know is whether the goods you’re selling. Motor vehicle taxes & fees. currently,. Utah Tax On Services.

From www.signnow.com

Utah Tax ID Number Lookup Complete with ease airSlate SignNow Utah Tax On Services For more information on sales & use taxes,. the utah sales tax rate in 2023 is 4.85% to 8.85%. currently, combined sales tax rates in utah range from 4.7 percent to 8.7 percent, depending on the location of the sale. Note regarding online filing and paying: One of the first things you need to know is whether the. Utah Tax On Services.

From utahtaxpayers.org

PostPandemic, How High Are State and Local Taxes in Utah and the Utah Tax On Services For more information on sales & use taxes,. the utah sales tax rate in 2023 is 4.85% to 8.85%. while utah's sales tax generally applies to most transactions, certain items have special treatment in many states when it. utah sales tax on goods and services. 101 rows this page lists the various sales & use tax. Utah Tax On Services.

From www.templateroller.com

Form TC62S Fill Out, Sign Online and Download Fillable PDF, Utah Utah Tax On Services 101 rows this page lists the various sales & use tax rates effective throughout utah. One of the first things you need to know is whether the goods you’re selling. while utah's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Motor vehicle taxes & fees. The state of utah. Utah Tax On Services.

From zamp.com

Ultimate Utah Sales Tax Guide Zamp Utah Tax On Services Note regarding online filing and paying: 101 rows this page lists the various sales & use tax rates effective throughout utah. One of the first things you need to know is whether the goods you’re selling. currently, combined sales tax rates in utah range from 4.7 percent to 8.7 percent, depending on the location of the sale. . Utah Tax On Services.

From www.slideshare.net

tax.utah.gov forms current tc tc941r Utah Tax On Services utah sales tax on goods and services. One of the first things you need to know is whether the goods you’re selling. The state of utah does not usually collect sales taxes on the vast majority of. the utah sales tax rate in 2023 is 4.85% to 8.85%. currently, combined sales tax rates in utah range from. Utah Tax On Services.

From www.pdffiller.com

Fillable Online tax utah Utah State Tax Commission Utah Taxes Utah Tax On Services Note regarding online filing and paying: while utah's sales tax generally applies to most transactions, certain items have special treatment in many states when it. This comprises a base rate of 4.85% plus a mandatory local rate of 0% to 4%. are services subject to sales tax in utah? Motor vehicle taxes & fees. utah sales tax. Utah Tax On Services.

From www.dochub.com

Utah tc 20 instructions Fill out & sign online DocHub Utah Tax On Services For more information on sales & use taxes,. are services subject to sales tax in utah? currently, combined sales tax rates in utah range from 4.7 percent to 8.7 percent, depending on the location of the sale. the utah sales tax rate in 2023 is 4.85% to 8.85%. Note regarding online filing and paying: 101 rows. Utah Tax On Services.

From kslnewsradio.com

The good news for taxpayers in Utah lower state and local tax rates Utah Tax On Services 101 rows this page lists the various sales & use tax rates effective throughout utah. Motor vehicle taxes & fees. For more information on sales & use taxes,. This comprises a base rate of 4.85% plus a mandatory local rate of 0% to 4%. The state of utah does not usually collect sales taxes on the vast majority of.. Utah Tax On Services.

From www.pinterest.com

Orem Utah tax rates as of 2016 Orem utah, Utah, Orem Utah Tax On Services One of the first things you need to know is whether the goods you’re selling. while utah's sales tax generally applies to most transactions, certain items have special treatment in many states when it. For more information on sales & use taxes,. Note regarding online filing and paying: utah sales tax on goods and services. currently, combined. Utah Tax On Services.

From klinglercpa.com

Filing Your Federal Taxes In Utah Accountants Utah Utah Tax On Services utah sales tax on goods and services. the utah sales tax rate in 2023 is 4.85% to 8.85%. Note regarding online filing and paying: 101 rows this page lists the various sales & use tax rates effective throughout utah. Motor vehicle taxes & fees. For more information on sales & use taxes,. The state of utah does. Utah Tax On Services.

From incometax.utah.gov

Use Tax Utah Taxes Utah Tax On Services while utah's sales tax generally applies to most transactions, certain items have special treatment in many states when it. For more information on sales & use taxes,. are services subject to sales tax in utah? the utah sales tax rate in 2023 is 4.85% to 8.85%. The state of utah does not usually collect sales taxes on. Utah Tax On Services.

From martinasambhavi.blogspot.com

17+ Tax Calculator Utah MartinaSambhavi Utah Tax On Services This comprises a base rate of 4.85% plus a mandatory local rate of 0% to 4%. the utah sales tax rate in 2023 is 4.85% to 8.85%. currently, combined sales tax rates in utah range from 4.7 percent to 8.7 percent, depending on the location of the sale. For more information on sales & use taxes,. The state. Utah Tax On Services.

From utahtaxpayers.org

Utah’s Wireless Taxes Top Neighboring States and Rank 12th Highest in Utah Tax On Services the utah sales tax rate in 2023 is 4.85% to 8.85%. For more information on sales & use taxes,. The state of utah does not usually collect sales taxes on the vast majority of. 101 rows this page lists the various sales & use tax rates effective throughout utah. Note regarding online filing and paying: This comprises a. Utah Tax On Services.

From webinarcare.com

Small Business Taxes in Utah Our Essential Guide Utah Tax On Services currently, combined sales tax rates in utah range from 4.7 percent to 8.7 percent, depending on the location of the sale. Note regarding online filing and paying: For more information on sales & use taxes,. One of the first things you need to know is whether the goods you’re selling. The state of utah does not usually collect sales. Utah Tax On Services.

From utahtaxpayers.org

One Third of Utah’s Expenditures Come from the Feds Utah Taxpayers Utah Tax On Services The state of utah does not usually collect sales taxes on the vast majority of. are services subject to sales tax in utah? One of the first things you need to know is whether the goods you’re selling. currently, combined sales tax rates in utah range from 4.7 percent to 8.7 percent, depending on the location of the. Utah Tax On Services.